Stimulus Money Fills Big Need For Some

Makana Bruhn is a nurse at Straub Medical Center and a mother of three young kids, between the ages of 3 and 9. During this coronavirus outbreak she plans to take some days off of work as much due to care for her children. Bruhn has a lot on her plate and she received the stimulus payment on April 15, she said. Bruhn is also a single mother that claims her kids on her taxes. She will receive an additional $500 per child to the stimulus payment.

“Because I’m a nurse I’m not trying to work as much because I have my three kids to think about,” said Bruhn, a 33-year-old from Kahaluʻu, Oahu. “This check that’s coming will be helping me out. With this check, I can put it to the groceries or things that kids might need.”

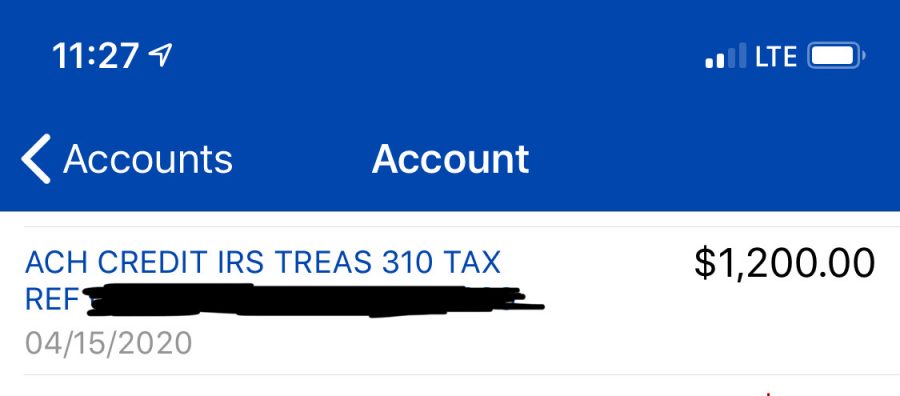

The United States government is sending out $1,200 stimulus payments, starting on April 15 due to the coronavirus outbreak. Most adults with a U.S. Social Security number will receive a payment, but Congress set restrictions on who qualifies. Everyone with direct-deposit will be going out on April 15. Then they’ll start sending out paper checks, according to Business Insider, on April 10.

People who earn more than $99,000 per year will not receive any money. Neither will many college students or adults who are listed as dependents on someone else’s tax return which includes some adults with disabilities and some elderly parents. Immigrants who do not have Social Security numbers will not qualify for the payments either.

Not every person who qualifies will receive $1,200, according to USA Today, on March 27. Some will get more money or some less. The payments are based on your income listed on your most recent tax return, as well as the number of child dependents you have. As many as 93.6 percent of tax filers will receive some kind of payment, according to the Tax Foundation.

“I’ve had my eyes on a pair of Nike shoes that I think I might use the check on,” said Bo Kawika, a 23-year-old student of Windward Community College. “I’m still working so why not treat myself with the extra money. I need to cheer myself up.”

Kawika is a college student that also has a job at Costco Wholesale. He claims himself as independent on the taxes so he qualifies. If your parents don’t claim you as a dependent, such as young people who entered the workforce after college, you will qualify for the payments.

According to Vox, an online newspaper, many college students and young adults will not qualify for these payments. You will not get any money, and if you are 17 or older your parents won’t get $500 for you either.

“It’s exciting this $1,200 check,” said Bernie Kaea, a 78-year-old retiree from Kaneohe, Oahu. “Getting money from the government is an awesome deal. Of course I’m sad I’ll be missing out on it, but hey good for everyone else. It would’ve been nice to use that check for new window screens.”

Elderly parents do not qualify for the payments, according to USA Today. If you claim any adult as a dependent on your tax returns including adult children with disabilities living at home, you will not get any additional money on their behalf.

“Well it’s about damn time the government did something smart,” said Leinaʻala Wong, a 50-year-old flight attendant from Kaneohe, Oahu. “Not only is this brilliant of them but it also makes it seem like the government has a heart for once. I’m a single parent and I’m also a flight attendant so this check couldn’t have come at a better time.”

Wong is out of work right now due to flights being canceled. She works for Hawaiian Airlines and has been working there since she was 24. Wong is also a single parent of a 16-year-old and a 20-year-old. Since she is the head of the household, she has a higher limit to qualify for the payments than single people without kids.

Single parents who make up to $112,500 will get the full $1,200 benefit, according to Business Insider, on April 14. The system then works the same way with payments shrinking by $5 for every $100 you earn above that threshold up to $136,500. You will also qualify for $500 per dependent child you have who is age 16 or younger.

“Me and my husband file our taxes together,” said Nani Dias, a 53-year-old Kailua, Oahu. “We plan to use the check for essential things because we are both out of work at the moment. This is a great thing the government is doing and lots of people like us who aren’t working can benefit from it.”

According to CNBC, both the payments and the limits are doubled for your home if you file your taxes jointly. Couples with household income of up to $150,000 will receive a $2,400 payment. At higher household income levels, the payments shrink and stop entirely at $198,000.

“I’m going to save the check,” said Haunani Bulgo, a 54-year-old from Honolulu. “Both me and my husband are essential workers so it’s not like we need to use the check for anything. We’d rather just save the money and maybe use it down the road.”

Congress is already talking about the need to pass more stimulus packages. It is too early to say what will be next but Congress has also topped up unemployment insurance, paying out $600 per week on top of state benefits, according to The Denver Channel, on April 15. You can find the status of your stimulus payment on the IRS website.