CUH Financial Rating Now 3 Levels Below ‘Investor-Grade’

Students should not worry about the latest credit rating to befall Chaminade University, the vice president for Finance and Facilities Aulani Kaanoi said.

In January, Chaminade University’s credit rating fell down the scale from “Ba2” down to “Ba3” by credit rating agency Moody’s Investors Service.

Organizations with a “Ba” credit rating are subject to substantial credit risk.

“There are universities with lower credit ratings or no credit ratings at all, that are operating and will continue to operate,” Kaanoi said.

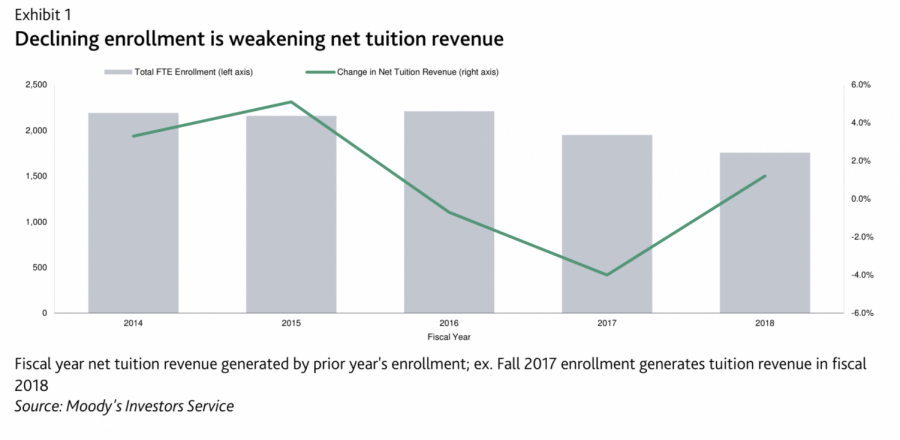

According to the credit rating firm, the university saw an “unexpected 10 percent decline” in enrollment numbers for Fall 2018, in which a similar decline was seen in Fall 2017.

The rating firm also suggests that the outlook for fiscal year 2019 “looks negative.”

However, Kaanoi said that the recent financial updates should not deter students from coming to Chaminade.

“It has nothing to do with [questions pertaining to] ‘can we afford to complete your degrees, are we going to be here 20 years from now,’” Kaanoi said. “That’s not what [Moody’s] is saying at all.”

A six-page credit opinion issued by the investor service in January stated that Chaminade’s “weakened credit profile” is reflective of years of “double-digit” enrollment declines. Moody’s further stated that this could hamper the university’s operations in fiscal year 2019 and beyond.

However, Kaanoi said that declining enrollment is seen nationwide.

“What Chaminade is dealing with is nothing different than [Hawaii Pacific University],” Kaanoi said. “Small private universities on the mainland are dealing with the same thing.”

U.S. News reports that in 2019, Hawaii Pacific University has a total enrollment of 4,146 students. Moody’s reports that Chaminade has 1,757 students as of Fall 2018.

Faculty Senate President and accounting professor Richard Kido agreed.

“Chaminade has been experiencing enrollment declines for the past several years, and that’s a nationwide trend,” Kido said. “Smaller institutions all over the U.S. have difficulty maintaining enrollment, mainly because of demographics.”

According to Kido, there is a declining population of college-aged students, and that it is worse here in Hawaii than it is in the mainland.

“It’s now harder to attract students to come to Chaminade,” Kido said. “That’s a trend that the administration is trying to devise strategies [in order to] fight it.”

A look at Chaminade’s organizational tree shows that in the past year, the university has hired new members for its marketing team. Chaminade has also created two new roles in its advancement office: Director of Alumni Engagement and Annual Fund and the Donor Relations Events Manager.

Kaanoi said that Chaminade has also partnered with “The Common Application,” a website that lets potential college students apply to over 700 colleges at one time using one application.

The university has also created a new undergraduate major that deals with data sciences. That major is expected to launch next fall.

Faculty Worries

Kaanoi said it’s been a tough year, in regards to Chaminade’s finances. However, she says that faculty members shouldn’t worry about cuts.

“No one should be worried about losing their job at this point, those are not in the discussions,” Kaanoi said.

According to her, the university is always “reevaluating” its needs.

“We continue to be strong, we’re gonna continue to be here for a long time to come,” Kaanoi said. “But [the rating] means that we are suffering some market…enrollment challenges.”

Kido, however, shared different sentiments.

“Anytime there’s a negative financial impact, everybody should be worried,” Kido said.

He does not believe that the rating will impact the students as much as faculty.

“I don’t think right now that it will impact faculty right away, but of course this would be a worry to faculty,” Kido said. “Anytime there’s cost-cutting involved, there’s a little bit of a worry.”

“Of course, being a financial guy, I understand the finances, and of course I’m worried,” Kido said. “I think it’s more a longer term worry…not so much an immediate impact sort of thing.”

Kido said that increasing enrollment is key.

“[Getting high enrollment rates] is biggest thing we need to do in order to get our financial house in order,” Kido said.